Should your client use the transitional CGT relief?

The new legislation gives SMSF trustees having pension assets exceeding $1.6 million or a TRIS affected by the reforms a choice to make regarding capital gains. Trustees can choose to reset the cost base of their assets that cease being part of an income stream to comply with the transfer balance cap or TRIS reforms.

The reset can occur at any time during the pre-commencement period (9th November 2016 – 30th June 2017) after the asset ceases being a segregated current pension asset or otherwise on 30th June 2017 if the proportionate method is used.

The choice can be made on an asset-by-asset basis – which allows trustees to choose which assets they provide the relief to.

You can select an asset that makes a deemed capital loss to offset against any gains in the 2016-17 year and the unused losses if any can be carried forward. However, a capital loss on a deemed sale of the asset cannot be deferred.

How this can affect a client is best demonstrated with an example.

For Example

Tom is 66-years-old. He has a fund with his wife Lisa, who is 57-years-old.

Tom has $1.7 million as an account based pension and Lisa has $850,000 in accumulation.

The fund uses the proportionate method to calculate exempt current pension income. As a result of the new Pension Cap, Tom will roll back $100,000 into accumulation.

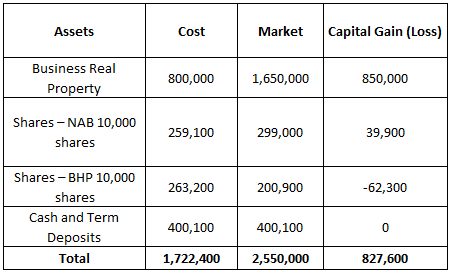

The funds’ assets are as follows:

Note: The business real property is leased to their son’s business. It is in a well sought after area, so even if the son’s business shuts down finding replacement tenants would be easy.

Tom wants to know if he should use the transitional CGT relief provisions.

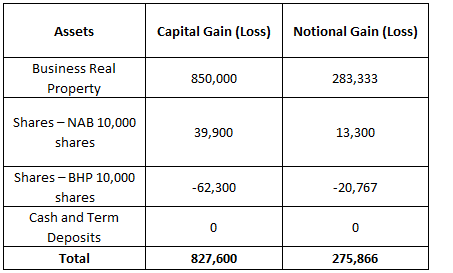

Firstly, let’s calculate the notional gain.

Two-thirds of the fund – Tom’s portion – will be exempt from CGT – which means the notional gain is 1/3 of the capital gain.

Now look at the assets on an asset by asset basis.

Should they reset the cost base of the business real property?

Things to consider

- The business real property has a large capital gain.

- Lisa is 57 years old.

- If they reset the cost base the gain is locked in – it is an irrevocable election.

- If the property is not sold until Lisa is over 65-years-old and in pension mode the capital gain would be tax exempt. (Except for Tom’s small portion in accumulation).

- If the property does get sold prior to Lisa turning 65, the additional capital gain tax payable in comparison to the election would be approx. 4 per cent of the gain.

- Remember the business real property is leased to their son’s business and it is in a well sought after area.

Conclusion

No – It’s not worth locking in the gain when Lisa is so close to retirement and they are unlikely to sell before she retires.

Should they reset the cost base of the shares?

Things to consider

- The shares are more likely to be sold than the business real property if cash is required.

- The loss on the BHP shares is greater than the gain on the NAB shares so no tax is payable.

- The remaining loss on the BHP shares can be carried forward and used to offset gains in future years.

Conclusion

Yes – resetting the cost base of the shares doesn’t result in a tax liability and allows for the remaining loss to be carried forward.

Remember

- CGT Relief is not automatic.

- The choice is irrevocable and must be made before a trustee is required to lodge their fund’s 2016-17 income tax return.

- Choice must be made on an approved form.

- The choice is made on an asset-by-asset basis.

- A fund will need to keep appropriate records for the assets subject to CGT relief.

- For deferred gains – At a minimum keep records of the assets to which CGT relief was applied and the 2016-17 non-exempt portion of the deferred notional gains for these assets so that when capital gains or losses on those assets are later realised, the deferred notional gain can be brought into account in that future income year.

Deanne Firth, director, Tactical Super